The evolution of cardiac surgery has dramatically lessened the risk of going under the knife. These days, some hospitals specialize in heart health only. However, it took a lot of steps to reach this point. Here’s a brief history…

The evolution of cardiac surgery has dramatically lessened the risk of going under the knife. These days, some hospitals specialize in heart health only. However, it took a lot of steps to reach this point. Here’s a brief history…

1893 – The first successful surgery on the heart was performed in Chicago.

1925 – A young woman was successfully operated on when the surgeon opened a chamber and inserted a finger to find and feel her damaged valve.

1952 – A congenital heart defect was successfully corrected and the first cardiac surgery under local anesthesia was performed.

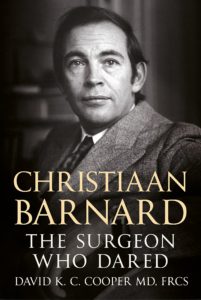

In 1967, the first human-to-human heart transplant was performed in South Africa by Dr. Christiaan Barnard.

By the early 1990s, surgeons began to perform off-pump coronary bypass. This means the heart continues to beat during the procedure but is stabilized to be almost still while bypass vessels are sown in.

Today numerous procedures can be performed with small incisions instead of wide openings that create that “zipper look” scar down the chest. It’s possible that in the future, the term “open-heart” will become obsolete.

It is important to have a good daily routine that includes 3 basic steps: cleanse, moisturize and protect. It doesn’t have to be complicated. Use a gentle cleanser and wash your face every morning and night. Follow that up with an appropriate moisturizer for your skin type. For day time, always wear sun protection. SPF 30 is best. Reapply throughout the day. This will protect your skin from sun damage and skin cancer.

It is important to have a good daily routine that includes 3 basic steps: cleanse, moisturize and protect. It doesn’t have to be complicated. Use a gentle cleanser and wash your face every morning and night. Follow that up with an appropriate moisturizer for your skin type. For day time, always wear sun protection. SPF 30 is best. Reapply throughout the day. This will protect your skin from sun damage and skin cancer. When it comes to heart disease prevention, little has changed. High cholesterol is still a factor, as are smoking and obesity. Now when it comes to keeping your heart healthy, think of these four words – sleep, activity, diet and stress.

When it comes to heart disease prevention, little has changed. High cholesterol is still a factor, as are smoking and obesity. Now when it comes to keeping your heart healthy, think of these four words – sleep, activity, diet and stress. Here is an

Here is an