We wanted to share this article from GoodRX about common medications that CAUSE joint pain! If one of your medications is on the list, discuss it with your doctor.

We wanted to share this article from GoodRX about common medications that CAUSE joint pain! If one of your medications is on the list, discuss it with your doctor.

Suicide – OUR Youth Crisis

We can all agree that suicide is at an all-time high with our youth. Why is it happening and how do we as adults help?

We can all agree that suicide is at an all-time high with our youth. Why is it happening and how do we as adults help?

When you talk to individuals who have considered/attempted to commit suicide, all the reasons are different. But the common thread is the OVERWHELMING feeling of DESPAIR (doom, downfall, discouragement, ruin, anguish, unhappiness).

Our youth today are spending more time on electronic devices and not enough time interacting with “real people.” This may cause a feeling of being all alone in the world. They are subjected to more negative comments, personal attacks and undesirable images than ever before.

Possible solutions? Limiting time on gaming and Smartphones. Participating in a confidence building activity (dance, sports, drama, art, music, well, you get the idea).

I leave you with this suggestion… I have gotten the most insight into my daughter’s life and now my grandkids’ lives when we are in the car driving and at the dinner table. We are all so busy making our lives that we forget to “LIVE our LIVES” not just exist. “RELAX! TAKE A BREATH! LISTEN! AND YOU WILL SEE!”

Contributed by Sandra Aguilera.

Youth Suicide Prevention

As a pastor I have been called to homes immediately following death by suicide. What I witness is a loss felt deeper than any other loss can be felt. It is a loss than sends shock waves through the air of the surrounding community. A death by suicide does not only impact the person that has died it impacts everybody around them too. It changes so many lives forever.

As a pastor I have been called to homes immediately following death by suicide. What I witness is a loss felt deeper than any other loss can be felt. It is a loss than sends shock waves through the air of the surrounding community. A death by suicide does not only impact the person that has died it impacts everybody around them too. It changes so many lives forever.

The most common question I am asked by the families and friends who have experienced the loss followed by death by suicide is WHY? Followed closely by the guilt vortex of, “If only I had…”

Death by suicide is an action borne out of desperation, great pain and mental illness. It is not a selfish act. Do not blame yourself if someone close to you commits suicide. It is not your fault.

Where suicide was once packed away in the shadows of society, we are evolving to openly discussing the existence of suicide; Its unrelenting pain and depression that leads up to the final act and the mental illness that accompanies the process.

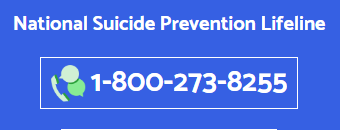

If you are concerned or have questions, don’t hesitate to contact the National Suicide Lifeline at 1-800-273-8255.

Ms. Chon Pugh is Lutheran pastor and a private counselor specializing in individual and family issues.

School Backpack Awareness

Did you know nearly 5,000 emergency room visits each year are the result of injuries related to backpack usage. The most common injuries being sprain/strains and subluxations potentially resulting in significant back pain. Some, if not most, of these injuries are preventable with proper usage/wearing. Here are a few things to consider.

Did you know nearly 5,000 emergency room visits each year are the result of injuries related to backpack usage. The most common injuries being sprain/strains and subluxations potentially resulting in significant back pain. Some, if not most, of these injuries are preventable with proper usage/wearing. Here are a few things to consider.

Backpacks are designed to be wore as high up on the back as possible with little to no slack between the surface of the backpack and the back. This allows for proper weight distribution which is key.

As a general rule of thumb, the entire weight of the pack should not exceed 20% of the persons body weight. This is vital especially with younger individuals.

Features of the backpack can enhance the ergonomics as well: Padded shoulder straps, lumbar pad, larger pockets closest to the individuals back, roller packs, etc. can make the stress of the pack less on the back.

In general, a good, quality pack along with proper usage can make a big difference on the individual wearing it. Should you have any questions regarding wearing/using a backpack please don’t hesitate to ask a health care professional you trust.

Article written by Dr. Eric Garst, owner of The Well Chiropractic Clinic. Dr Eric has been a chiropractor for 5 years. He’s accepting new patients. Go check out their website today!

Car Seat Safety

Car crashes are a leading cause of death for children ages 1 to 13. That’s why it’s so important to choose and use the right car seat correctly every time your child is in the car. Click here to visit the National Highway Traffic Safey Administration site: Find the right seat; Install the seat correctly; Register the seat for recalls/updates; Location for a professional to check the seat; Other resources.

Car crashes are a leading cause of death for children ages 1 to 13. That’s why it’s so important to choose and use the right car seat correctly every time your child is in the car. Click here to visit the National Highway Traffic Safey Administration site: Find the right seat; Install the seat correctly; Register the seat for recalls/updates; Location for a professional to check the seat; Other resources.

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 50

- Next Page »