Obesity is considered a medical condition. In 2018, about 42% of adults in the U.S. had obesity. Having a larger body or heavier weight is associated with serious health conditions such as heart attack, stroke, Type 2 diabetes, and cancer. Aside from medical effects, obesity also can impact social, mental, and economic aspects of your life. What are your options? What do those options cost? Click here to read more.

Obesity is considered a medical condition. In 2018, about 42% of adults in the U.S. had obesity. Having a larger body or heavier weight is associated with serious health conditions such as heart attack, stroke, Type 2 diabetes, and cancer. Aside from medical effects, obesity also can impact social, mental, and economic aspects of your life. What are your options? What do those options cost? Click here to read more.

Uninsured vs. Underinsured: What’s the Difference?

When it comes to health insurance, it’s easy to know if you’re uninsured: you either have coverage, or you don’t. But being underinsured is more of a gray area. You have health insurance, but because of a high deductible or other out-of-pocket costs, it doesn’t cover as much as you might need. Your income may not be high enough to offset the coverage gaps. This article breaks down what counts as being underinsured and the financial risks involved. Your IHC agent will review your particular situation at no charge to help you find the best solution for you.

When it comes to health insurance, it’s easy to know if you’re uninsured: you either have coverage, or you don’t. But being underinsured is more of a gray area. You have health insurance, but because of a high deductible or other out-of-pocket costs, it doesn’t cover as much as you might need. Your income may not be high enough to offset the coverage gaps. This article breaks down what counts as being underinsured and the financial risks involved. Your IHC agent will review your particular situation at no charge to help you find the best solution for you.

Tip of the Month

Check your medical records once a year! It’s very important for you to review the records due to mis-information being reported which can affect your ability to qualify for some health and life insurance policies. Request your report by visiting the Medical Information Bureau at https:www.mib.com or call 866-692-6901.

Check your medical records once a year! It’s very important for you to review the records due to mis-information being reported which can affect your ability to qualify for some health and life insurance policies. Request your report by visiting the Medical Information Bureau at https:www.mib.com or call 866-692-6901.

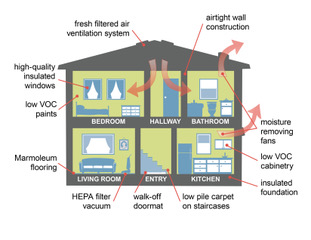

Breathing Easy At Home

Did you know over 24 million Americans including 7 million children suffer from asthma? Here’s the good news…

Did you know over 24 million Americans including 7 million children suffer from asthma? Here’s the good news…

It can be treated and managed so those affected can enjoy a normal life. The key is to reside in a home with as few triggers (like dust and mold) as possible. Breathe Easy Homes in Seattle, Washington are examples of homes built specifically to improve air quality. This is a growing movement in architecture and design.

If a new home isn’t in your future, don’t get discouraged. You do have options to your current home.

Here are a few suggestions:

Furniture

Select furniture made of leather, wood, metal or plastic. When it comes to curtains, go with washable plain cotton or synthetic fabrics. Also, washable roller-type shades collect less dust than horizontal blinds.

Paint

Most major paint manufacturers offer low and zero VOC (volatile organic compounds) that minimize emissions of gasses and solids at room temperature. As a result, you have a wide range of colors and finishes to choose from.

A/C Filters

Change air filters often as recommended by your AC specialist to remove dust and pollens as air circulates.

Flooring

If you have carpet, consider swapping it for tile or wood floors. Carpets are notorious for harboring dust, dirt and allergens. Hard floors are easier to keep clean.

These steps, along with regular cleaning and dusting make breathing easier for everyone!

The Best Time to Buy Shoes

Your shoes, and when you buy them, play a key role in foot and ankle health. When it comes to feet, it’s easy to ignore problems until that slight limp becomes pronounced and normal walking is impossible. Now it’s time to see the doctor.

Your shoes, and when you buy them, play a key role in foot and ankle health. When it comes to feet, it’s easy to ignore problems until that slight limp becomes pronounced and normal walking is impossible. Now it’s time to see the doctor.

Podiatrists are medical specialists who provide medical and surgical care for feet, ankles and lower leg problems. Conditions range from arthritis to aching legs and include problems like blisters, athlete’s foot and correcting abnormal walking patterns.

The good news is how many simple actions you can do to prevent problems. One is to promote good circulation through exercise, gentle massage and warm foot baths. Additional actions (or non-actions) like no smoking and sitting with your legs uncrossed contribute to good blood flow.

And don’t forget the shoes! Did you know the best time to buy shoes is in the late afternoon or early evening? (This is when your feet tend to be larger.) Choose ones that give your toes some wiggle room and don’t chafe your skin. From toenails to tendons – good foot, ankle and lower leg health care is your key to staying mobile.

- « Previous Page

- 1

- …

- 20

- 21

- 22

- 23

- 24

- …

- 29

- Next Page »