Here’s a list of 10 common mistakes new Medicare enrollees make and how to avoid them, according to the Medicare Rights Center, a nonpartisan, not-for-profit consumer service organization.

Here’s a list of 10 common mistakes new Medicare enrollees make and how to avoid them, according to the Medicare Rights Center, a nonpartisan, not-for-profit consumer service organization.

No pain, no gain? Science debunks another exercise myth!

Research suggests moderate exercise and physical activity is better, especially if you trade intensity for sustainability. You should strive to build habits around the physical activities you find enjoyable and fulfilling. Click here to continue reading.

Research suggests moderate exercise and physical activity is better, especially if you trade intensity for sustainability. You should strive to build habits around the physical activities you find enjoyable and fulfilling. Click here to continue reading.

Switch to Plant-Based Diet

A new study suggests following a healthy plant-based diet after a diagnosis of prostate cancer may help prevent the disease from progressing or recurring. Click here to continue reading.

A new study suggests following a healthy plant-based diet after a diagnosis of prostate cancer may help prevent the disease from progressing or recurring. Click here to continue reading.

Toxic Stress Load Is The Biggest Barrier to Living Longer

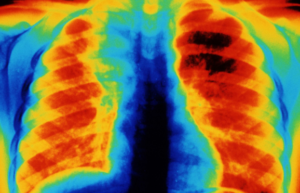

Americans’ Lung Health: The Poor Suffer Most

The health of your lungs may have a lot to do with the size of your bank account, a new, large study indicates.

The health of your lungs may have a lot to do with the size of your bank account, a new, large study indicates.

The finding follows a six-decade look at lung disease risk among more than 215,000 American children and adults.

In general, poorer Americans continue to have worse lung health than their wealthier peers. In some cases, the gap between rich and poor is widening.

- « Previous Page

- 1

- …

- 32

- 33

- 34

- 35

- 36

- …

- 50

- Next Page »